DEFENSE DEPARTMENT

Vital Signs 2024: U.S. Defense Industrial Base Still Facing Headwinds

By Jennifer Stewart

NDIA illustration

During the last 35 years, six U.S. administrations have worked tirelessly to deter peer conflict. But in many ways, the nation both forgot enduring truths regarding what national deterrence against peer competition requires and failed to successfully address the changing social, demographic and financial trends impacting the defense industrial base.

In addition, public consciousness lost the direct connection between a strong defense industrial base and effective national deterrence.

Informed by the tragedies of current conflict unfolding in multiple regions around the world, U.S. policymakers are more keenly conscious of the consequences of failed deterrence and the inexorable reality of what it would take for the U.S. military to prevail in multiple contingencies occurring simultaneously.

While technological advancements provide early tactical advantages, nations usually win or lose conflicts over the long term based on the strength and endurance of their political and military alliances, national treasuries and defense industrial bases.

The present U.S. defense industrial base reflects a premium policymakers placed on just-in-time supply chains and lowest-cost technically acceptable contract awards.

It also reflects outdated assumptions regarding workforce availability. It is a system built for convenience and predictability, and it is an industrial base the U.S. government resourced for low-intensity conflict.

To foundationally transform the defense industrial base, the government and the private sector must embrace a synergistic partnership and disruptive thinking.

In 1940, then-Chief of Staff of the Army Gen. George Marshall wrote: “For almost 20 years we had all the time and almost none of the money; today we have all the money and no time.” Simply put, time, funding and consistency are immutable factors for both military readiness and defense industrial readiness.

The National Defense Industrial Association’s “Vital Signs” report series is designed to track the progress made across the five strategic pillars required for a strong, diverse, resilient and ready defense industrial base in an era of strategic competition. The five pillars are: securing budget stability and sufficiency; advancing Defense Department digital modernization and transformation; facilitating foreign military sales modernization and technology integration with allies and partners; restoring industrial readiness, capacity and infrastructure; and enabling more resilient supply chains.

In “Vital Signs 2023,” NDIA noted the powerhouses of industrial readiness — stable and predictable budgets; an experienced and specialized workforce; diversified and modern infrastructure; manufacturing innovation; and sufficient, including idle, capacity — have all atrophied under the combined transition to a service-based economy with a premium on just-in-time commercial supply chains.

The report also noted that for the last 30 years, on a bipartisan basis, the U.S. government failed to resource the industrial footprint required to prevail in near-peer conflict.

“Vital Signs 2023” was a call to action for the federal government and the defense industrial base to partner more closely. NDIA was therefore encouraged with the release of the inaugural 2023 National Defense Industrial Strategy. It is an important first step to acknowledge that it would be strategic negligence to continue to allow atrophy of the defense industrial base and to not rebuild its resiliency in an era of great power competition.

“Vital Signs 2024” builds on the issues identified in both the previous annual surveys and reports as well as from NDIA member feedback regarding the 2023 industrial strategy. The survey of both NDIA members and government employees was conducted between Oct. 18 and Nov. 7. The poll closed with 1,397 responses. Of them, 568 were government employees and 829 respondents worked at an industry, university, research center or other non-government organization.

For the purposes of clarity in this article, industry, university, research center and non-government organization respondents are denoted as private sector respondents. Of the 829 private sector respondents, 418 represented small businesses.

The new report highlights areas that require improved alignment between government and industry. It will take time, financial investment and changes in systemic behavior patterns to reshape the defense industrial base into a threat-informed defense ecosystem with the capacity to grow its output, fulfill a surge in military demands and reconstitute during a major conflict.

The report focuses on the key areas where government and industry can partner together to better manage time and money in support of current national deterrence objectives.

In addition to emphasizing the importance of effectively managing time and money in restoring defense industrial readiness, the 2024 survey and report also seeks to highlight another tension — shared risk — that U.S. policy objectives are struggling to balance.

For example, traditional companies are operating under increasing scrutiny and oversight by both the executive and legislative branches while also competing more directly with both purely commercial and global companies for access to capital.

Policymakers want to attract and retain small and nontraditional companies into the U.S. defense ecosystem, but they are struggling to reduce significant barriers to entry and retention, including increasing compliance costs and concerns regarding intellectual property rights.

Policymakers are working on innovative offensive and defensive strategies as part of global technological competition, but Cold War-era frameworks continue to drive status quo outcomes.

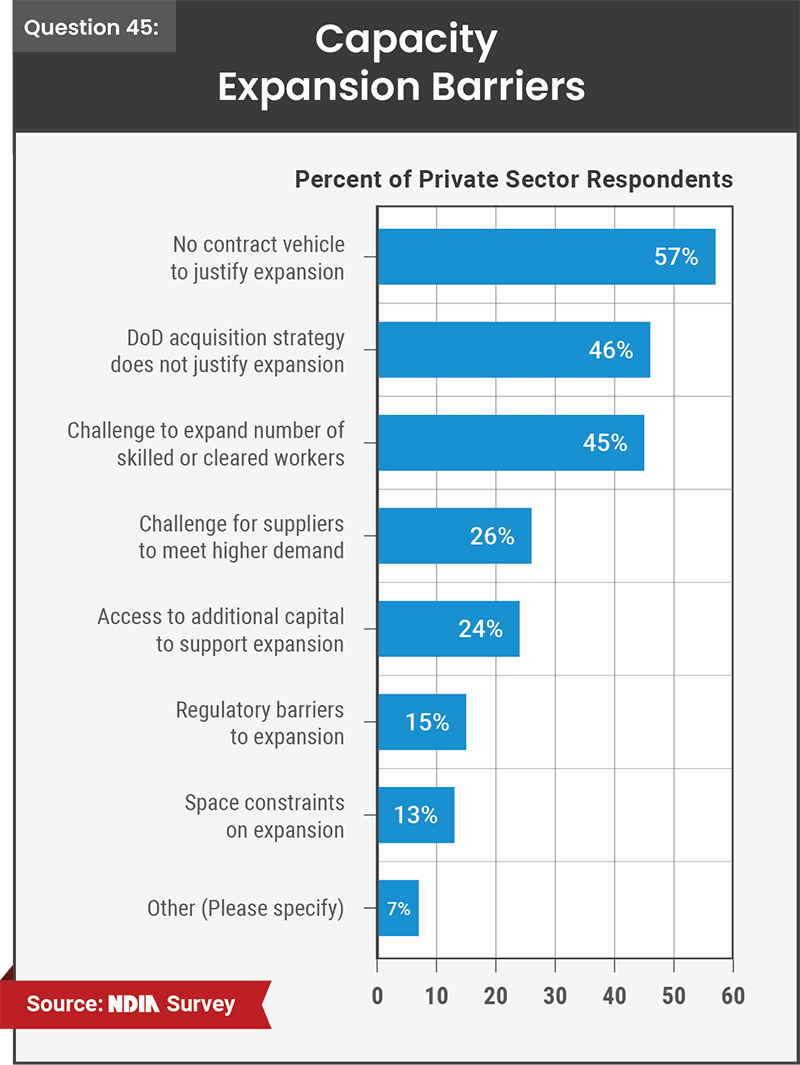

Meanwhile, these policymakers expect the defense industrial base to rapidly expand production capability before contract vehicles are awarded, but companies must justify pre-contract award capacity expansion to investors and navigate current government policies and regulations that discourage holding onto surge capacity.

Policymakers also expect companies to change their supply chain strategies, built during the last 35 years for consumer convenience and cost efficiencies without sufficient government financial incentives or consistency in acquisition strategies, including congressional approvals for advanced procurement and economic order quantities.

The results are like applying simultaneous and equal pressure to a vehicle’s brakes and accelerator. For the defense industrial base, the pressure to accelerate is being met with equal and abrupt pressures to reduce speed. Valiant efforts have been made to improve the government-industry partnership in many areas over the course of 2023, but uneven political consensus limited those efforts to incremental improvements.

In several cases, if the U.S. truly intends to reverse current key industrial readiness indicators for great power competition, boldness will be required.

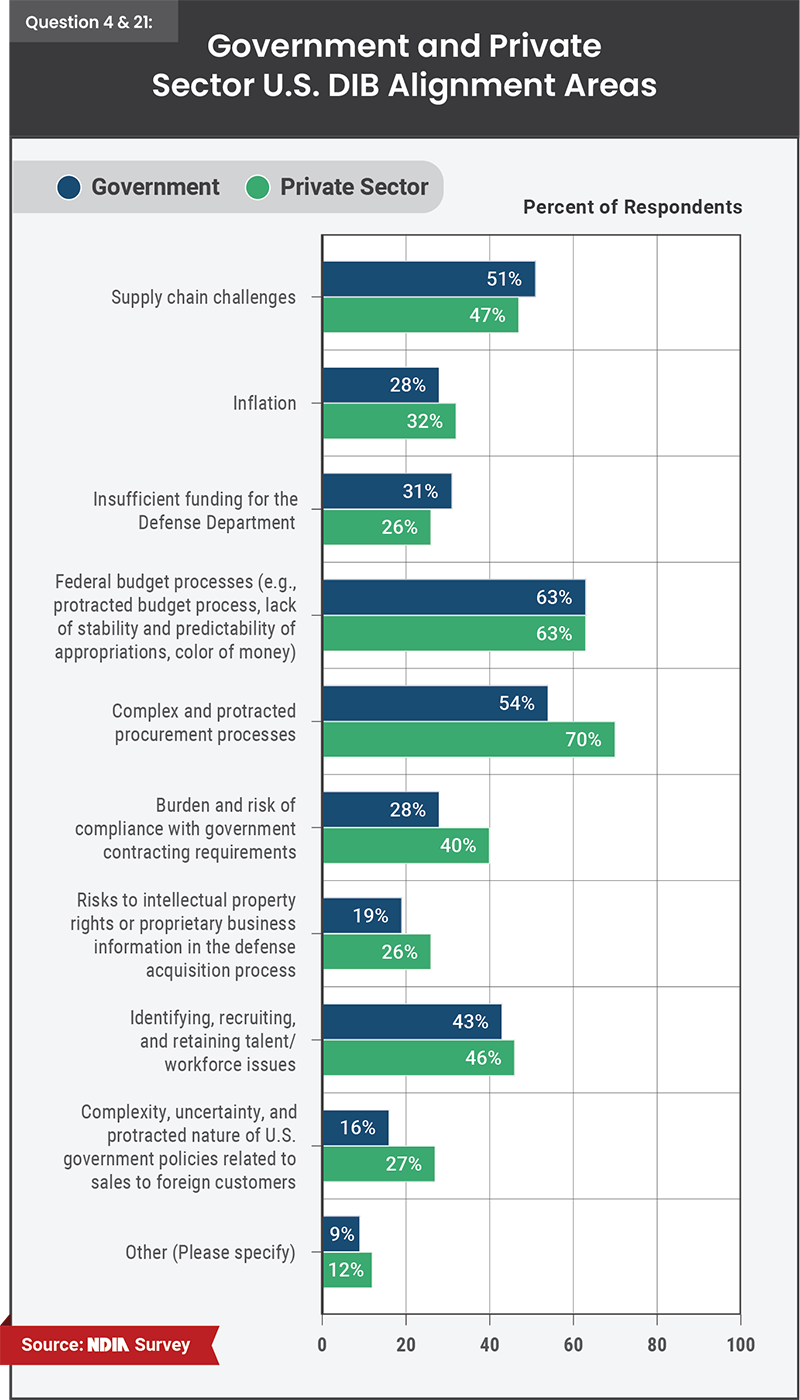

Meanwhile, the Defense Department and its industrial base need to create a synergistic partnership to operationalize a common endeavor to achieve a desired end state. In a synergistic partnership, it is important to identify areas of alignment and areas of misalignment. Therefore, the “Vital Signs 2024” survey included a select number of questions NDIA asked both federal government and private sector respondents. Of note, there was significant alignment by both government and private sector respondents on the most pressing issues facing the industrial base. (See Q4/Q21 chart)

The 2024 report will address key areas of alignment and misalignment between government and the private sector, including the supply chain, inflation and workforce challenges.

First, regarding supply chain, the combination of geopolitical factors and the lessons learned from the 2020 global pandemic have increased public policy interest in the availability and responsiveness of industrial supply chains across all sectors.

Both the executive branch’s and legislative branch’s work on supply chains reflect a growing, bipartisan policy interest by both the previous and current administrations to reduce vulnerability in strategic supply chains. It is a recalibration of the post-Cold War policy framework that prioritized efficiency and lower costs as benefits to taxpayers. The new framework now also seeks to incorporate policy priorities of limiting the People’s Republic of China’s access to cutting-edge technology, especially technology that can be diverted to military applications and to build alternative supply chains in sectors where China currently dominates.

This recalibration is having a seismic impact on the entire economy, but it has an even deeper impact on the industrial base because of its smaller purchasing power compared to the rest of the U.S. economy.

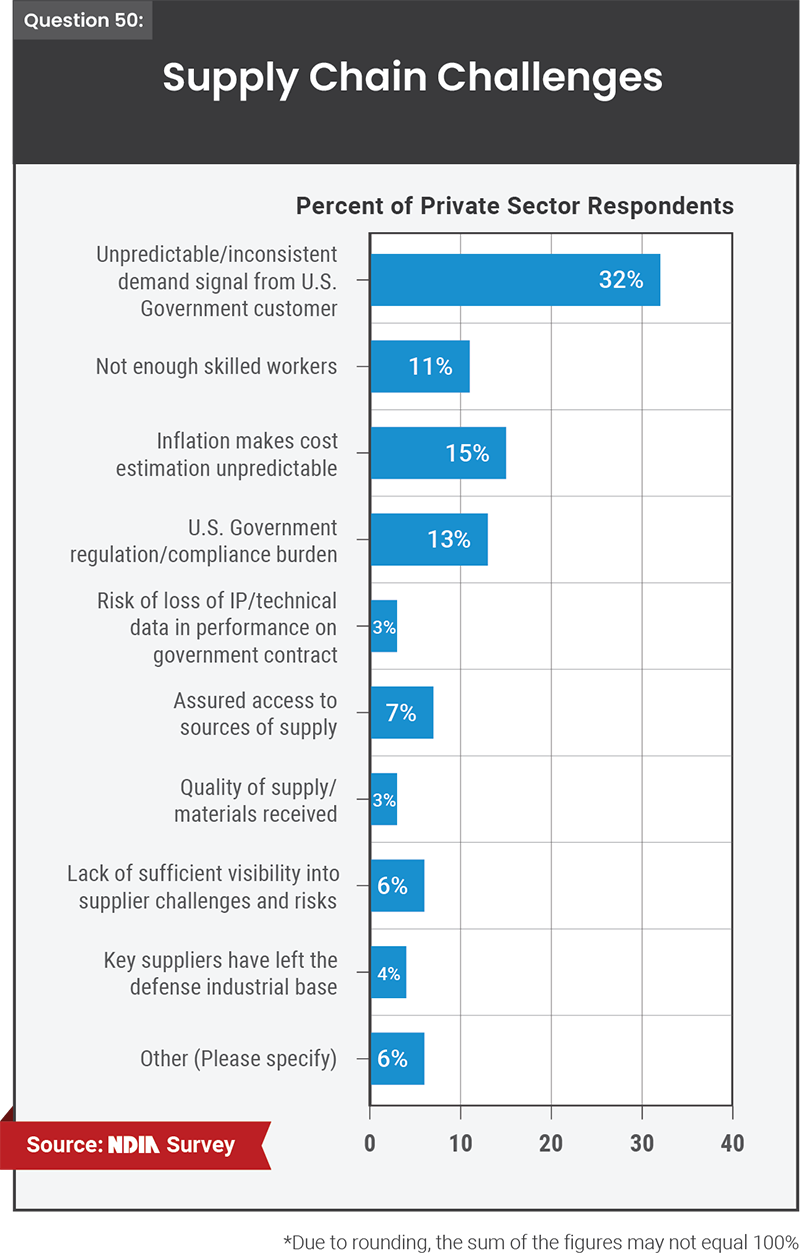

At the same time, the 2024 survey shows private sector respondents’ current biggest concerns regarding supply chain challenges are due to U.S. domestic challenges. (See Q50 chart)

The Vital Signs 2024 report will address these concerns spelled out in the chart, including the challenges with unpredictable and inconsistent demand signal from the U.S. government customer.

For example, the 2023 National Defense Industrial Strategy emphasized the importance of incentivizing industry to improve resilience by investing in extra capacity and recommended legislation to plan for spare production capacity and to provide oversight. Unfortunately, the defense industrial base is not incentivized by either the federal government or investors to carry extra capacity.

This is reflected in the survey, which asked private sector respondents several questions to identify the top barriers impacting industry’s ability to expand production. (See Q45 chart)

Any follow-on executive or legislative branch efforts should consider the fact that currently neither the federal government nor the investor community incentivizes the industrial base to carry significant surge capacity. Neither wants to pay for economic inefficiencies, including idle facilities, idle capacity and high indirect rates for labor.

Inflation also continues to be a significant challenge for industry. In multiple government-industry forums throughout 2023 across different defense sectors, the issue of historic inflation levels was consistently cited as an ongoing concern. Many companies highlighted both pre-pandemic and post-pandemic challenges with inflation.

For pre-pandemic contracts, businesses reported significant labor and material cost increases above planned inflation escalation on long-term, firm-fixed-price delivery contracts. In many cases, companies reported they struggled to retain both employees and current suppliers, and several reported stretching delivery schedules to manage the financial viability of current contracts. These cost increases negatively impact contractors who have limited opportunities for contract modification, especially when there are no Economic Price Adjustment clauses.

In the case of new contracts, companies noted that providing and sticking to pricing for labor and materials has become extremely challenging. For example, in a government-industry forum to discuss critical ammunition issues, one sector succinctly noted that pricing continues to be an issue due to short validity periods.

In the same meeting, the small business sector report stated that in the current hyperinflationary environment, providing and holding pricing for labor and materials has become extremely challenging.

In addition, both prime contractors and suppliers who dealt with inflation challenges on firm-fixed-price multiyear procurement contracts awarded pre-pandemic and during the pandemic report that the ongoing challenges of managing the unplanned inflation escalation are making suppliers risk averse about committing to new long-term contracts.

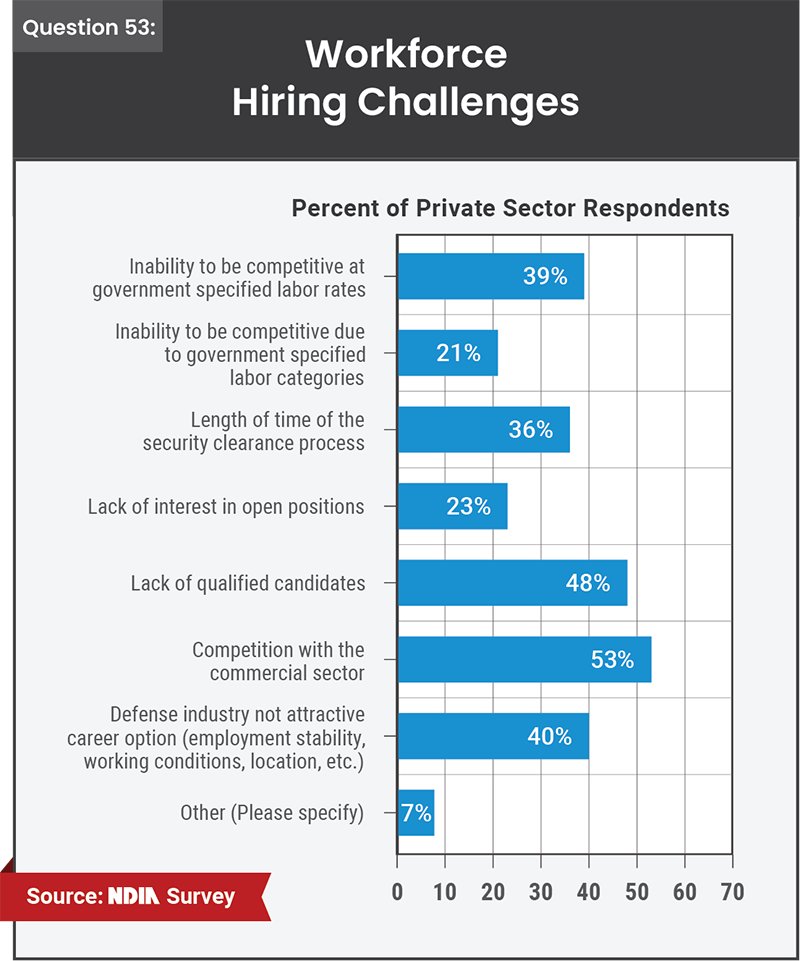

Meanwhile, the recruitment and retention of a highly skilled and trained workforce is a cross-cutting issue across all five strategic pillars on which a modern, diverse and resilient industrial base is built.

The 2023 National Defense Industrial Strategy highlights the fact that the U.S. labor market lacks sufficient workers with the right skills to meet domestic production and sustainment demand. For example, in 1985 the United States had 3 million workers in the defense industry.

However, by 2021 the country had 1.1 million workers in the sector, a reduction of nearly two-thirds.

An experienced workforce meters how quickly different sectors of the defense world can scale and sustain production. In addition, workforce recruitment and retention issues are also critical factors behind lengthening lead times in supply chains because the extended timelines often reflect how long it will take suppliers to increase their workforce to meet demand.

The “Vital Signs 2024” survey therefore sought to identify the top barriers to filling current vacancies. (See Q53 chart)

The “Vital Signs 2024” report will provide recommendations to address these challenges as well as survey results and recommendations for the strategic pillars required for a strong, diverse, resilient and ready defense industrial base in an era of strategic competition, which are not covered in this article.

A strong U.S. defense industrial base serves as a foundational element of national deterrence. In a global race for economic and technological supremacy, the United States must simultaneously wisely manage the clock, strategically invest its funding and appropriately balance risk between government and industry to ensure the military and the defense base achieve and maintain the readiness levels required to deter aggression. The consequences of losing the race will impact the values, standard of living and security of every American.

We can afford to be ready. ND

Vital Signs 2024 is available at: www.ndia.org/policy/publications/vital-signs

Jennifer Stewart is the National Defense Industrial Association’s executive vice president for strategy and policy.

Topics: Defense Department, Defense Contracting